The 2017 tax bill significantly changed the structure of the tax code, generating a great deal of anxiety and uncertainty across the sector. In October 2018, Independent Sector partnered with Tax Policy Center to convene national experts in tax policy and philanthropy from across the country to help us answer the question:

What do we know about this issue and how can we take action now?

Participants spanned political ideologies and technical expertise, including researchers, academics, federal agency personnel, and nonprofit staff. The roundtable discussed a broad range of topics where opinions differed. However, this diverse group of experts were able to agree upon a few key points on giving and public policy that we know for sure:

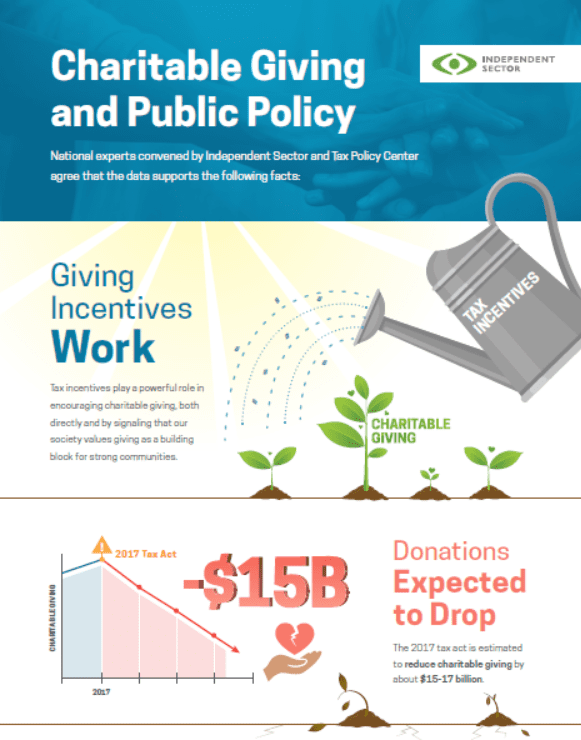

- Giving Incentives Work: Tax incentives play a powerful role in encouraging charitable giving, both directly and by signaling that our society values giving as a building block for strong communities.

- Donations Expected to Drop: The 2017 tax act will reduce annual charitable giving by approximately $15 billion.

- Fewer Households Give: There is widespread concern about the continued decline in the number of donors and the increased concentration of giving at the very top of the income spectrum. Household giving dropped by 11 percent between 2000 and 2014.

- Congress Needs to Act: Changing tax policy, such as expanding charitable giving incentives to all taxpayers, could combat these trends and create a fairer tax code that helps charities serve all members of their community.

Please feel free to share these highlights with peers and policymakers by downloading this graphic.

This roundtable was possible thanks to the generous support of our funders, including Charles Stewart Mott Foundation and the Fidelity Charitable Trustees Initiative.