Independent Sector is currently working with the Tax Policy Center and Indiana University to obtain updated estimates and real-time data that reflect the impact of the final Tax Cuts and Jobs Act.

The Tax Policy and Charitable Giving research study done last year by Indiana University Lilly School of Philanthropy found that a key proposal in the tax bill, increasing the standard deduction, could decrease charitable giving by $11 billion. Though researchers based their findings on an earlier draft of the tax bill, it remains a viable estimate of the potential impact of the Tax Cuts and Jobs Act.

Here are additional resources on the impacts of the Tax Cuts and Jobs Act bill:

- Final Tax Reform Bill Summary, Independent Sector, January 5, 2018

- 21 Million Taxpayers Will Stop Taking the Charitable Deduction Under The TCJA, Tax Policy Center, January 8, 2018

- Charitable organizations saw a spike in giving at the end of 2017, possibly due to donor uncertainty about the future of the charitable deduction – January, 2018

- Gifts to Vanguard Charitable Rose 16% Last Year

- Online Giving Trends (also seeing giving declines in 2018, compared to January 2017)

- $8.5 Billion Poured Into Fidelity Charitable Accounts in 2017

- Original House tax bill could decrease giving (an estimated decrease of $12-$20 billion due to changes in the charitable deduction and an additional $4 billion due to changes to the estate tax), The Tax Policy Center, November 15, 2017

What We Know about 2018 so far:

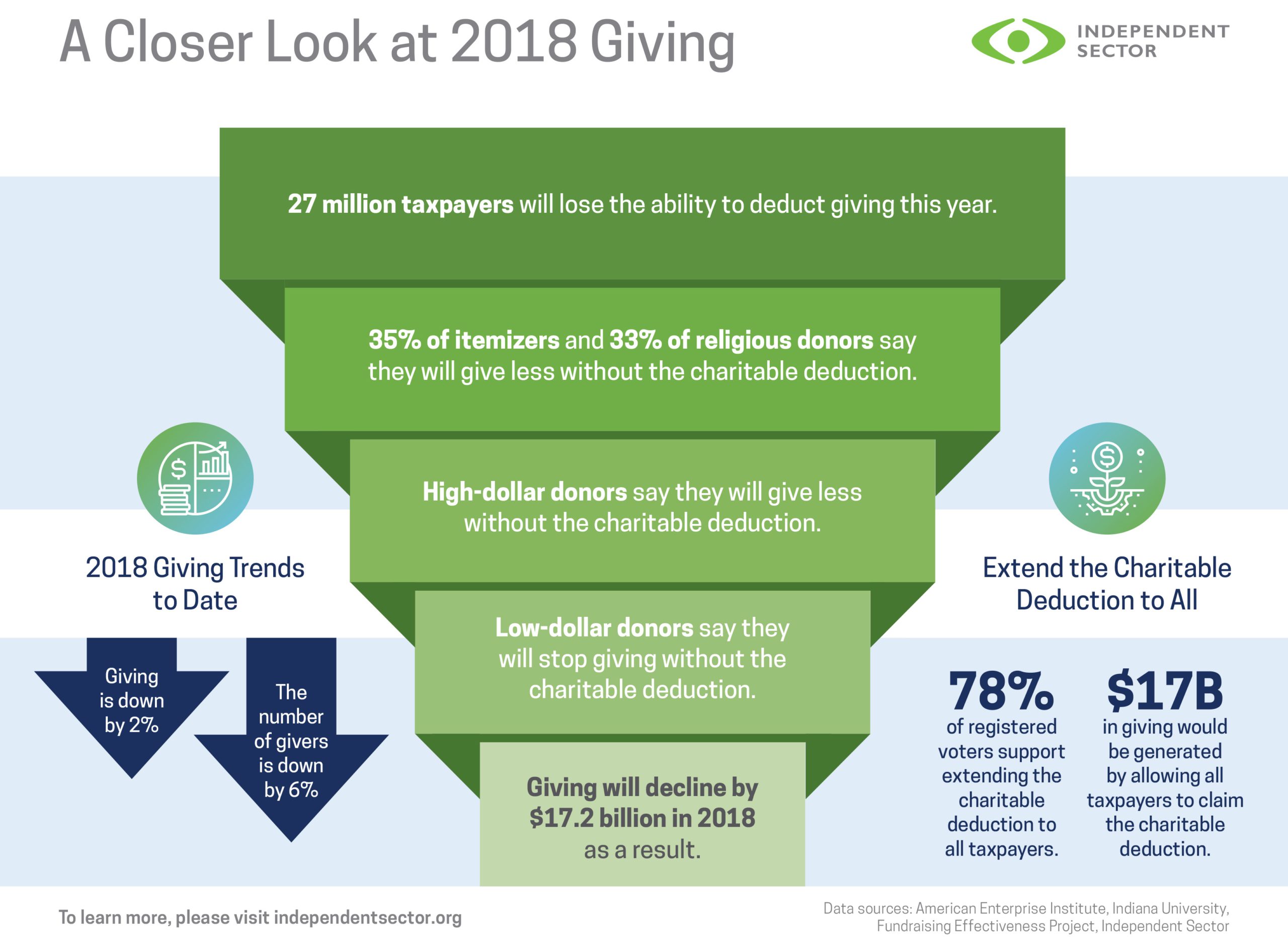

- 2018 Charitable Giving Trends (First infographic below)

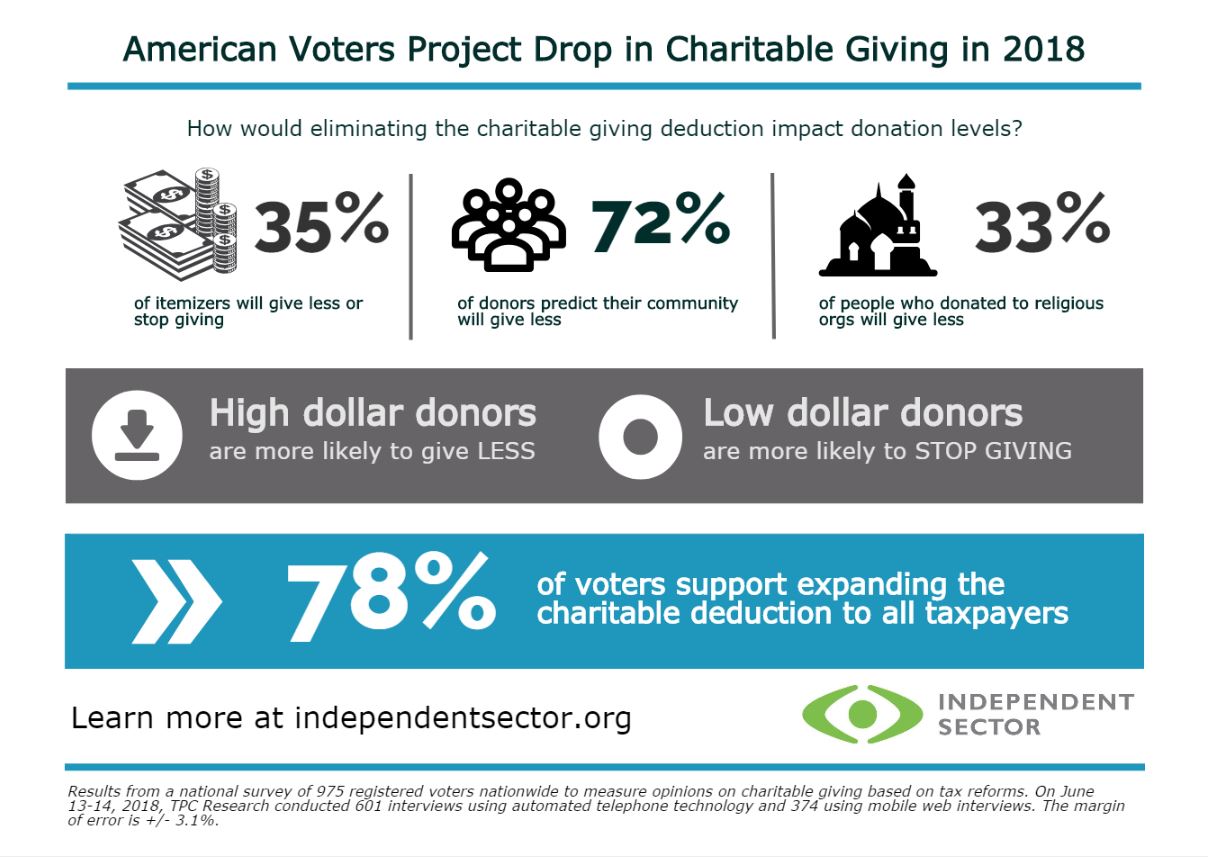

- Poll: American Voters Project Drop in Charitable Giving in 2018 (Second infographic below)