Clarifying Nonprofit Civic Engagement Rules

When charities engage in nonpartisan civic engagement such as lobbying and encouraging people to vote, our democracy becomes stronger. While they are absolutely – and appropriately – prohibited from engaging in any “political campaign”, unclear definitions lead many charities not to engage at all.

The Issue

Currently, the IRS does not adequately define nonprofit political activity, leaving its examiners to look at the “facts and circumstances” of each case to decide whether something constitutes impermissible political activity. Independent Sector strongly believes that the rules governing political activity in the nonprofit sector need to be improved to allow all nonprofits to more easily comply with the law.

What’s at Risk?

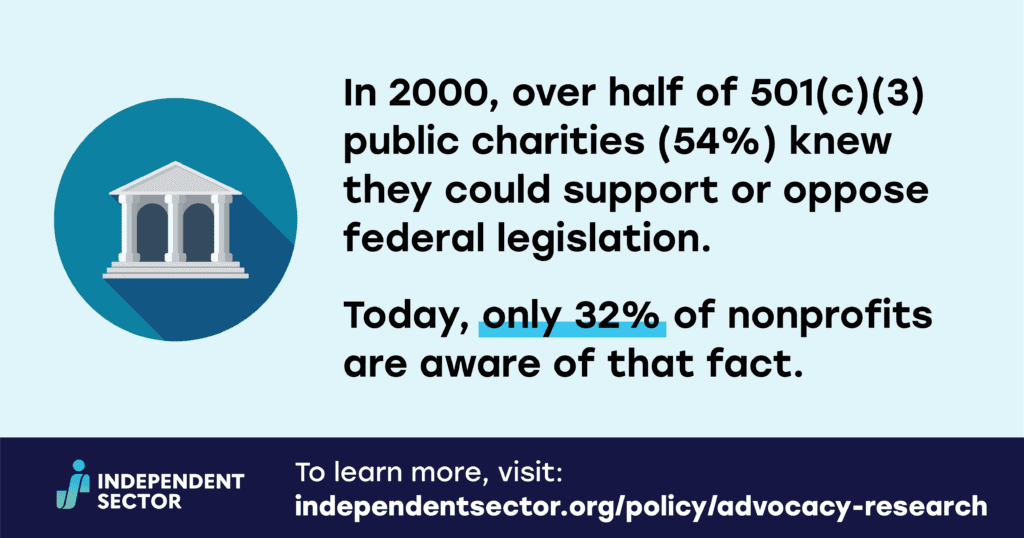

America is stronger when nonprofits and the communities they serve are at the table shaping the public policies that directly impact them. At present, many nonprofits face uncertainty in attempting to comply with the IRS’ vague “facts and circumstances” approach to cases of political intervention. For instance, charities (501(c)(3) organizations) know they cannot support or oppose a candidate for elected office. Yet there are many educational activities related to elections that could be undertaken by charities without violating the law. The lack of clarity in what constitutes impermissible political intervention also has implications for other tax-exempt groups. Social welfare groups (501(c)(4) organizations) and trade associations (501(c)(6) organizations), for example, are permitted to engage in some political activity, but they must demonstrate that it is not their primary purpose.

This raises two problems. First, how do you know what to count as political activity if it is not clearly defined? Second, how do you define how much activity is “primary” without clear definitions of what you are measuring? This isn’t just a problem for nonprofits and those they serve. Without objective definitions, it is increasingly hard for the IRS to decide whether to approve tax– exempt applications – or to enforce the rules for those organizations that already have their tax exemption.

In September 2023, Independent Sector responded to a Request for Information from the U.S. House Ways and Means Committee, urging policymakers to provide increased clarity on the definition of “political campaign intervention.

Define Political Activity Rules and Regulations

To remedy this, Independent Sector endorses the Bright Lines Project, a policy solution that would clarify ambiguous rules and boundaries surrounding nonprofit political activity through a framework of definitions, exceptions, and analytical steps for recognizing political intervention within the nonprofit sector. In one sense, we believe this approach will clear away the underbrush, remove the obstacles, and make an easier path for charities to fully participate in the public policy process as trusted representatives of their community.

The Bright Lines Project – a nonpartisan initiative undertaken by nonprofit lawyers in 2008 – has continued to adapt its solutions as the political system and technology have changed in recent years. While there are many potential frameworks that could improve on the current and confusing “facts and circumstances” test, there is a clear need for increased clarity.