Independent Sector spends a lot of time talking to legislators about tax incentives for charitable giving. This year, we’ve been asking them to make the charitable deduction available to all taxpayers in order to prevent the loss of billions of dollars in giving. We are happy to report that there is one thing that seemingly every legislator agrees on: they are eager to see the 2018 data.

It may be the better part of two years before we have the comprehensive data that one might prefer, and we can’t afford to wait that long. So, in the meantime, Independent Sector has undertaken several efforts to provide policymakers with a more immediate understanding of the tax law’s impact on giving.

It may be the better part of two years before we have the comprehensive data that one might prefer, and we can’t afford to wait that long. So, in the meantime, Independent Sector has undertaken several efforts to provide policymakers with a more immediate understanding of the tax law’s impact on giving.

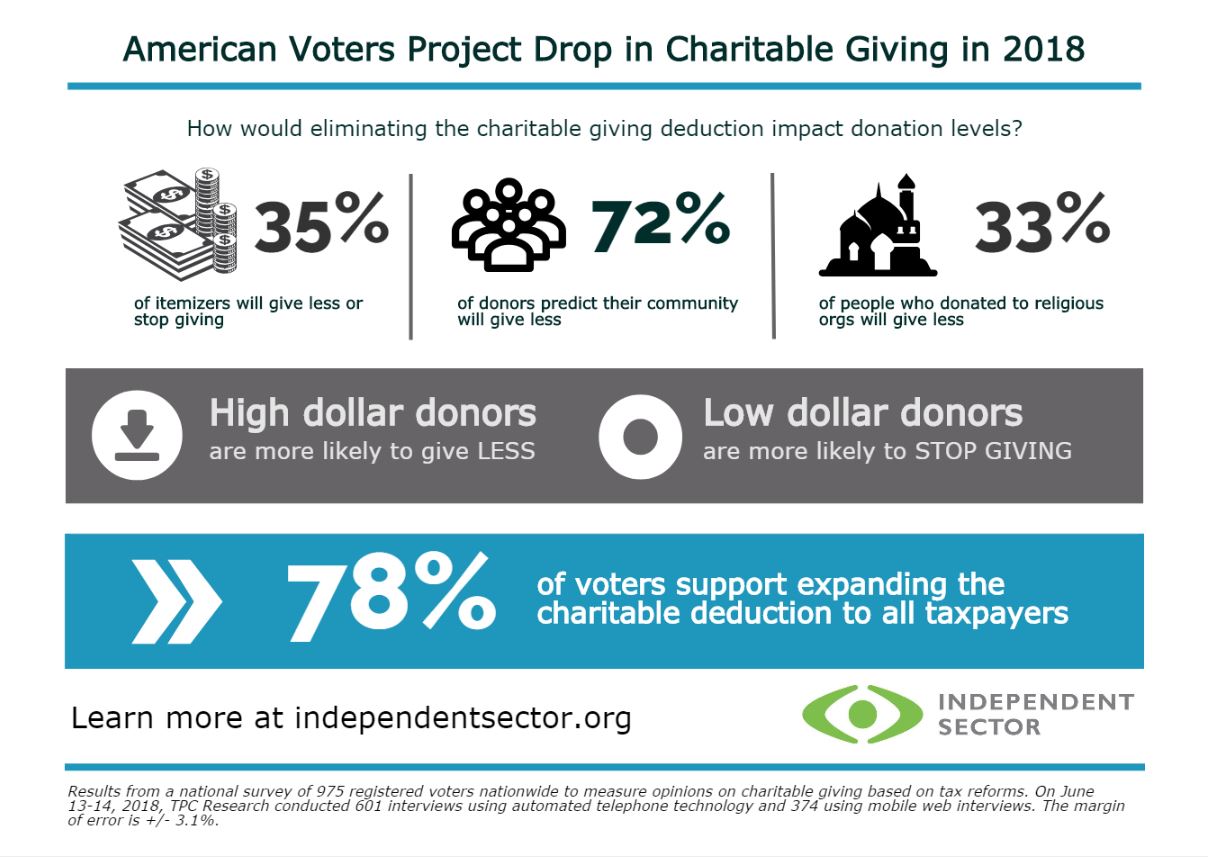

Earlier this month, we worked with TargetPoint Consulting to survey 975 registered voters nationwide about their impressions of their own giving in 2018, the giving of those in their community, and about one potential policy solution. Here are the results:

- 35 percent of voters who filed itemized returns last year say they will stop giving or give less in 2018

- 72 percent predict that people in their community will give less to charity this year

Given people’s general reservation about telling a pollster that they may give less to charity, we believe that the number of taxpayers who may alter their giving may be much higher. If people’s own behavior mirrors that of the tax sensitivity they ascribed their neighbors, the decline in giving could be precipitous. We also found that high dollar donors were more likely to report giving less while low dollar donors were more likely to stop giving altogether.

The survey also found that 33 percent of donors to religious organizations will stop giving or give less in 2018. This puts religious giving within the standard margin of error of giving for the broader group of donors. These findings are consistent with research that Independent Sector commissioned with Indiana University last year—religious givers are no less sensitive to tax incentives than those who give to nonreligious organizations.

Finally, we also found support for expanding the charitable deduction to all taxpayers among 78 percent of voters. This level of support for any public policy extremely high, but the finding is in line with polling that Independent Sector commissioned in March 2017.

All public polling comes with caveats, but these findings are further indication that the 2017 tax law will have a negative impact on charitable giving, and that there is public support for a solution. The survey contains a wealth of other information, which we look forward to analyzing and sharing in the near future.

Feel free to use this infographic – Charitable Giving Infographic 2018 – in meetings with your legislators.

Learn more about the research available on giving and the 2017 tax bill.