Thanksgiving leftovers may still be lingering in the fridge, but as we shift from the season of gratitude to the season of giving, we’re not just wrapping up holiday plans but the 118th Congress, too. Much like we’re racing to check off year-end to-do lists, Congress is scrambling to finish its own, with must-pass legislation and last-minute negotiations on the docket. This period for the charitable sector mirrors the chaos on the Hill: With Giving Tuesday and looming deadlines, everyone’s hoping to do as much good as possible before the end of the year. But as Congress adjourns and we head toward the December holidays, it’s worth remembering that the spirit of giving drives people this time of year — whether it’s supporting a cause or giving the perfect gift to put a smile on a loved one’s face.

Appropriations Deadline Approaching

In September, Congress passed, and President Joe Biden signed, a continuing resolution to keep the government funded through December 20, 2024. With this deadline fast approaching, Congressional leadership has yet to announce their next steps. The most likely scenario appears to be punting the issue into 2025 for the newly elected Republican trifecta to address at a later date.

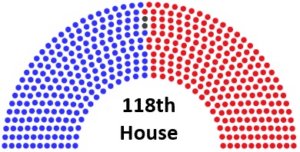

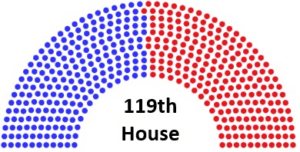

There is uncertainty about the duration of the next continuing resolution, which will largely depend on when Republican leadership wants to tackle the issue next year. The House’s narrow majority adds complexity to the equation. Expected Republican resignations early in 2025, as members leave Congress to join the new administration, will make the House one of the most closely divided in U.S. history, with Republicans holding just a one-seat majority until special elections fill the vacancies.

Given the slim margin, Republican leadership will likely push for a continuing resolution this month that funds the government at least through the special elections, expected to occur in the spring. However, the special election timeline will hinge on the exact timing of the resignations.

House Passes Legislation that Poses a Threat to Nonprofits, Due Process, and Humanitarian Work

On November 12, 2024, and again on November 21, 2024, the House of Representatives voted on H.R. 9495, the Stop Terror-Financing and Tax Penalties on American Hostages Act. While its title suggests noble intentions, the bill includes a troubling provision that threatens the work of law-abiding nonprofits operating in conflict zones and undermines constitutional due process protections.

The problematic provision would grant the Secretary of the Treasury sweeping authority to designate 501(c) nonprofits as “terrorist-supporting organizations” without requiring full disclosure of the evidence or reasoning behind such designations. Organizations accused under this provision would face severe consequences, including the loss of their tax-exempt status, reputational damage, and restricted access to financial institutions —challenges that would also harm the beneficiaries of their work.

Perhaps most concerning is the reversal of due process: Nonprofits would bear the burden of proving their innocence within a mere 90-day window, an onerous standard that ignores the realities of providing assistance in conflict zones, even when done in compliance with Office of Foreign Assets Control (OFAC) authorizations.

Recognizing the dangerous implications of this legislation, Independent Sector joined Council on Foundations, National Council of Nonprofits, and United Philanthropy Forum to publicly oppose the bill through a joint statement on November 15. Our advocacy mobilized nearly 500 IS members and supporters to contact their representatives, urging them to vote against H.R. 9495. This collective effort contributed to a critical shift: 34 Representatives who initially supported the bill on November 12 reversed their position and voted against it on November 21.

The first vote on November 12 required a two-thirds majority for passage and fell short, with an outcome of 256-145, just shy of the super majority needed for passage. However, the second vote on November 21 required only a simple majority and passed narrowly, 219-214. Despite this setback, the Senate is not expected to consider this bill before the end of the 118th Congress. However, the House or Senate could reintroduce the bill in the 119th Congress.

Nonprofits play a vital role in addressing global crises, and we cannot allow their life-saving work to be undermined by legislation that disregards due process and endangers the communities they serve. It is already illegal to provide material support to foreign terrorist organizations. IS supports measures that identify and punish bad actors but remains steadfast in our opposition to measures that could be politicized and weaponized against the charitable sector. We will continue to stand against measures that threaten the ability of these organizations to carry out their missions and the trust they have earned from the people who rely on them most.

Federal Court Strikes Down Biden Overtime Rule

On November 15, 2024, the U.S. District Court for the Eastern District of Texas struck down the Department of Labor’s (DOL) recent rule raising the salary threshold that must be met for employees to be classified as exempt from overtime under the Fair Labor Standards Act (FLSA). The court ruled that the DOL exceeded its statutory authority in three ways — by setting salary thresholds too high, by creating an automatic update mechanism, and by prioritizing salary over job duties in determining exemptions. This decision not only nullifies the planned January 1, 2025 increase, but also retroactively nullifies the July 1, 2024 increase that had been in effect for more than four months at the time of the ruling. Additionally, the court decision cancelled the scheduled automatic increases.

Employers in states with higher salary thresholds — such as Alaska, California, Colorado, New York, and Washington — remain unaffected by this ruling and should continue to follow the thresholds established by their state. While employers may now reconsider adjustments made under the now-invalid rule, they are not required to. The Biden-Harris administration could continue to appeal this decision, but with the upcoming administration change, further action is uncertain. Employers should watch for future updates and stay informed on potential changes to federal or state salary rules.

Growing Support for the Universal Charitable Deduction

On December 3, 2024, IS joined more than 470 charitable and nonprofit organizations from all 50 states and the District of Columbia on a letter to House Ways and Means Committee Chairman Jason Smith (R-MO) and Ranking Member Richard Neal (D-MA), and Senate Finance Committee Chairman Ron Wyden (D-OR) and Ranking Member Mike Crapo (R-ID), calling for a permanent charitable deduction for non-itemizers to be included in a year-end 2024 tax package or the final 2025 tax reform package.

“This Giving Tuesday, as the number of individual givers continues to decline, supporting tax policies like an expanded charitable deduction is more critical than ever to encourage all Americans to support their communities,” said IS President and CEO Dr. Akilah Watkins. “Polling shows 77% of Americans back expanding this proven incentive, recognizing its vital role in strengthening the nonprofit sector to address urgent needs nationwide.”

The Charitable Act (S. 566/H.R. 3435) is a bipartisan bill that seeks to restore and expand the expired nonitemized deduction for charitable giving that would ensure Americans who donate to charities, houses of worship, religious organizations, and other nonprofits of their choice can deduct that donation from their federal taxes at a higher level than the previous $300 deduction. Currently the Charitable Act has 24 cosponsors in the Senate and 65 cosponsors in the House. IS urges you to ask your Senators and Representative(s) to consider cosponsoring The Charitable Act or thank them if they are already a cosponsor.

Bipartisan Hurricane Relief Bill Seeks to Expand Charitable Giving

On November 21, 2024, Representative Vern Buchanan (R-FL), joined by his colleagues Gus Bilirakis (R-FL), Sheila Cherfilus-McCormick (D-FL), Neil Dunn (R-FL), Drew Ferguson (R-GA), Scott Franklin (R-FL), Laurel Lee (R-FL), Anna Paulina Luna (R-FL), Greg Murphy (R-NC), Greg Steube (R-FL), and Daniel Webster (R-FL), introduced the Hurricane Milton and Helene Tax Relief Act (H.R. 10203). This bill seeks to provide critical tax relief to individuals and businesses affected by the destruction caused by Hurricanes Milton and Helene.

H.R. 10203 would allow all taxpayers to deduct donations made to relief efforts in qualified hurricane disaster areas, even if they do not itemize their deductions. For taxpayers who itemize, the bill raises the limit on donations to 100% of adjusted gross income, an increase from the current 60%. Corporations would also see their giving limit raised from 10% to 20% of income. Additionally, the measure extends the deadline for making tax deductible contributions until April 15, 2025, giving donors extra time to support relief efforts and still claim those contributions on their 2024 tax returns.

Currently, the bill has 12 co-sponsors. Representative Buchanan’s office is actively seeking additional support to demonstrate bipartisan backing, with the goal of securing a vote before the end of the year or including the bill in the upcoming appropriations package. If you are reaching out to your Representative about other charitable legislation, such as the Charitable Act, please consider also urging them to support H.R. 10203 to ensure much-needed relief reaches hurricane-affected communities.

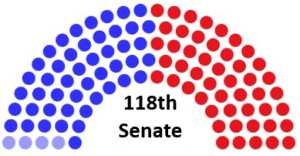

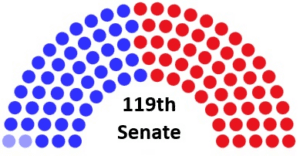

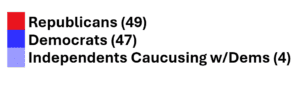

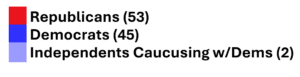

Shifts in Congressional Power: Political Landscape in the 119th Congress

On January 3, 2025, the winners of the 2024 election will be sworn into office, ushering in a shift in the balance of power in Congress. Republicans will gain control of the Senate for the first time since 2020, while maintaining their majority in the House. While House and Senate Democratic leadership are expected to remain unchanged, the most significant change in Senate leadership is the election of Senator John Thune (R-SD) to serve as Majority Leader for the 119th Congress. Senator Thune will succeed Senator Mitch McConnell (R-KY), who has been the Republican leader since 2007 and holds the record as the longest-serving Senate party leader in U.S. history.

Republicans will begin the 119th Congress with a 53-47 majority, following successful electoral flips in Montana, Pennsylvania, Ohio, and West Virginia.

Over in the House, the composition remains largely unchanged from the 118th Congress. Republicans will hold a narrow 220-215 majority as the 119th Congress begins.

These numbers may shift slightly in the coming months. President-elect Trump has already started tapping members of Congress for positions in his administration, which will create vacancies and trigger special elections.

Foundations on the Hill 2025

The 22nd Annual Foundations on the Hill, hosted and presented by United Philanthropy Forum and the Council on Foundations in partnership with Independent Sector, will be held in Washington, DC from February 23-26, 2025. For more than two decades, Foundations on the Hill has brought philanthropies, foundations, charitable sector leaders, and advocates to strengthen our collective impact on federal policy. Foundations on the Hill provides a unique opportunity to engage with policymakers and build relationships with partners across the sector. Registration for this signature event is now open with an early bird rate of $297 until January 31. Register today and we hope to see you in Washington in February.